MICHAEL WALSH INTERNATIONAL REAL NEWS

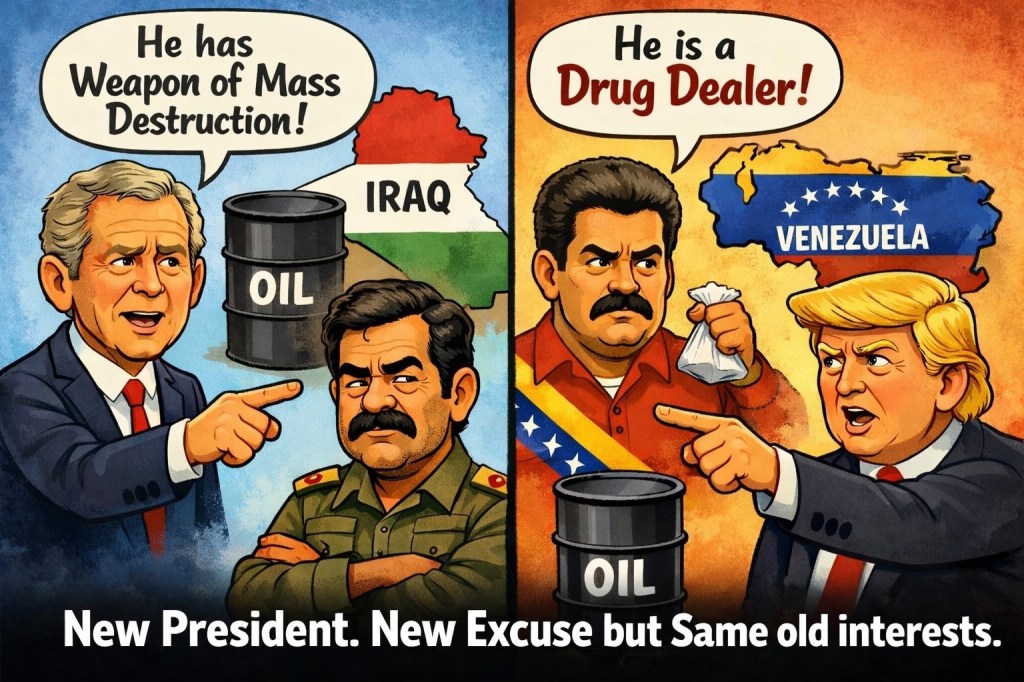

Oil Slick Trump says the US would control 55% of the world’s oil. The president has unveiled a plan to open Venezuela’s petroleum industry to American companies.

President Donald Trump has stated that the US would control more than half of the world’s oil production. This would occur if American companies regain access to Venezuela’s and Iran’s petroleum industry.

Venezuela has the world’s largest proven oil reserves. It legally and with compensation nationalized the assets of US companies in the 2000s. This occurred during the presidency of socialist Hugo Chavez.

Trump cited what he claims was unfair nationalization. This was one of the reasons he sent commandos last week. Their mission was to abduct Chavez’s successor, Venezuelan President Nicolas Maduro, from his compound in Caracas.

‘We’re going to be working with (hijacked) Venezuela.’ Trump made this statement on Friday. He was at a meeting with executives from oil giants ExxonMobil, Chevron, and ConocoPhillips at the White House.

‘American companies will have the opportunity to rebuild Venezuela’s energy infrastructure. They can eventually increase oil production to levels never seen before. When you add Venezuela and the United States together, we have 55% of the oil in the world,’ he added.

Trump claims that after the meeting, US companies would invest at least $100 billion in Venezuela’s oil production.

Big Oil Isn’t Interested

Exxon CEO Darren Woods said, however, that Venezuela was ’uninvestable’. An overhaul of regulations and a restructuring of its energy sector are needed.

The Venezuelan government has not confirmed granting access to American companies. Delcy Rodriguez is a close Maduro ally who was sworn in as acting president in his absence. She said earlier this week that Caracas was open to energy projects with all parties, including the US.

Venezuelan officials have denounced what they describe as Trump’s plan to pilfer the country’s resources. They also condemned the abduction of Maduro as a gross violation of sovereignty.

Trump’s Plan is rejected by the major oil companies

American oil majors left a White House meeting. They did not sign up for a fast money push into Venezuela’s oil sector.

This decision followed the illegal capture of the country’s legitimate President Nicolas Maduro, reports Axios.

The Trump administration has floated a $100 billion taxpayer funded investment figure, promising security and direct deals with the US. But executives kept their distance.

Exxon CEO Darren Woods bluntly called Venezuela ‘uninvestable’ under current legal and commercial conditions.

Big Oil companies are dubious that Trump’s oil grab will prevail. Once the mop flops amidst world reaction, Venezuelan oil is likely to continue under the control of the elected Venezuelan government

Furthermore, many think Trump will attack Iran. If he does, the United States will lose the clout and credibility it needs to secure the Venezuelan oil grab.

RIGHT. Catch up on real history by clicking the picture

ConocoPhillips’s Ryan Lance stressed the need to talk with banks, likely including the US Export-Import Bank, on how to restructure debt to deliver the billions of dollars that are required to restore their energy infrastructure’

Chevron, the only US major still operating in Venezuela, stuck to cautious language, focusing on employee safety and ‘compliance with all laws and regulations applicable to its business, as well as the sanctions frameworks provided for by the US government’

A handful of independents reportedly signaled interest. However, Venezuela’s output is around 800,000 barrels per day, which is still far below its past peaks.

With legal risks front of mind, Wall Street’s oil titans aren’t exactly racing back in.

Getting back to the 3.5 million barrels per day level of the late 1990s could require much more than $100 billion. This investment would need to be spread over a significant number of years, according to analysts cited by the outlet.

Oil prices are currently low. WTI crude is hovering around $59 per barrel, which also affects the reluctance. Major investments in Venezuela’s heavy crude projects would require much higher sustained prices to justify the risks and capital investments.

Thank you for sharing our stories on social media. TELL US WHAT YOU THINK

Categories: Political

1 reply »